As the business grows, the opportunities for expansion will also be higher. It could be that business people want to open branches on a local or domestic or global scale.

However, please note.

The expansion process can involve many risks, such as exacerbating existing problems or arising due to the opening of new branches.

Therefore, business people need to recognize any risks that might occur so that they can make an appropriate and precise expansion strategy to prevent them.

Contents

Types of Business Expansion Risks

It is crucial that a new company or branch recognizes the types of business expansion risks as early as possible in order to mitigate these or prepare for them if they occur.

The following are the types of business expansion risks that businesses need to know about;

Internal Risk

Companies often face internal risks that sometimes arise during the normal operations of the company.

This risk can also be predicted and prevented by preparing what actions to take if this happens. The following are three types of internal risks that business people need to know.

Internal readiness

Businesses should assess their internal readiness before opening a new branch. At the very least, the company must already know the goals it wants to achieve when expanding, whether the company has the capabilities needed to be successful, or has staff who can manage the new branch or not.

This evaluation can be done by focusing on the current success of the business, the costs required for expansion, and the availability of funds.

Companies also need to determine whether they want to expand or increase the number of branches by building new stores, through e-commerce only, or by building multi-channel.

Proven model

The business model helps businesses target the consumer base for their products or services. Besides that, it also helps in making marketing strategies, revenue projections, and costs by considering the type of business model used.

Every company needs to review the business model that it will or has used before deciding to expand.

Using a proven business model when opening new outlets will reduce the risk of business failure and increase its success.

Opportunity cost risk

Forbes describes opportunity hazard as the risk of making current decisions that result in lower returns than the business can expect in the long run.

Simply put, opportunity cost risk is the advantage that a business misses when choosing one option over the other.

For example, when a company has funds for investment, the business must decide whether to invest in developing existing products and optimizing existing branches, or deciding to open a store in another location.

Regardless of which option a company chooses, the potential gain lost by not investing in the other option is the opportunity cost.

External Risk

There is often an external risk associated with economic problems that arise outside the structure of the organization.

This type of risk cannot be controlled by the company and cannot be predicted in advance. The following are three external risks that are often faced by business people when expanding.

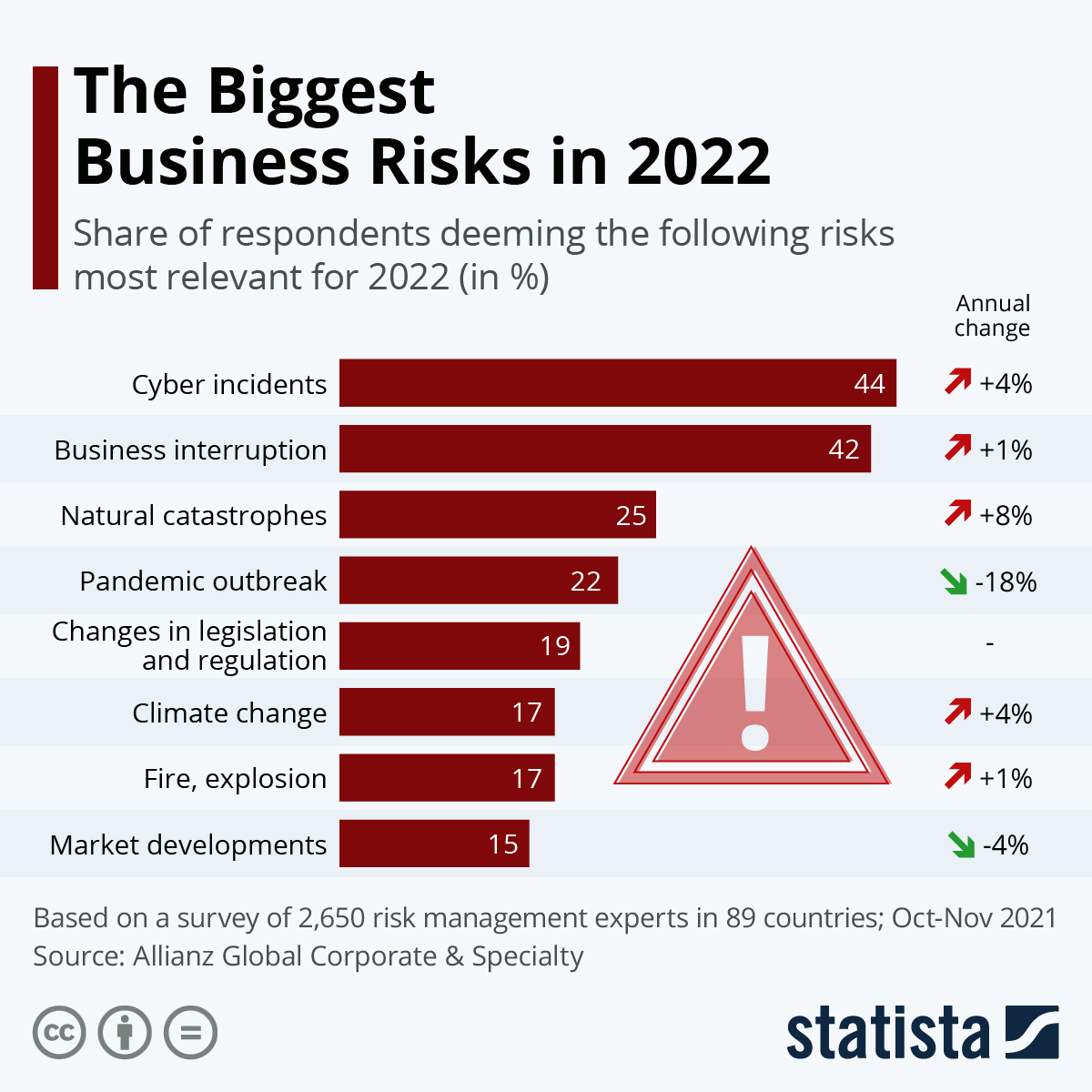

Economic risk

The first external risk is changes that occur in market conditions. An overall economic downturn can cause a sudden and unexpected loss of income.

For instance, coffee shop A operates in area B, but due to the storm of layoffs experienced by people who work around that location, their purchasing power has also decreased.

Companies can overcome the problem of economic risk by cutting costs or expanding their consumer base so that they are not only dependent on one particular segment or geographic area.

Natural risk

Indonesia is a country prone to natural disasters such as earthquakes, volcanic eruptions, floods, storms, tsunamis, and others.

Such natural risks can impact a business’s ability to keep its stores open for days to weeks after a disaster occurs. This ultimately led to a sharp decline in overall sales for the month.

Not to mention if the building you own is destroyed, the business will suffer material losses and be threatened with failure.

Political risk

The last external risk is a political risk which usually involves changes in the political environment such as conflicts and riots, regime or government changes, changes in international policies or relations between countries, as well as changes that occur in policies, business laws, or investment regulations of a country.

Other factors include high and low commodity or raw material prices, liquidity crises, and sectoral declines. For example, a change in the building tax rate could have a negative effect on business.

Increase Expansion Success with LOKASI Intelligence

It should be understood that any business activity has risks, including expansion into new markets. Mitigating this risk can be done by using technology that can help businesses to minimize it. One such technology is LOKASI Intelligence.

LOKASI itself is a spatial analytical platform that can help businesses to see whether the area where the new shop will be built is prone to natural disasters or not, the crime rate, and the history of disease outbreaks that have occurred in the area.

Learn more about how LOKASI Intelligence can help businesses by contacting email : [email protected] WA : 087779077750